Turnaround

Business expectations in trade and industry once again better than current business assessments for the first time

Commentary on the Logistics Indicator Q2 2024 by Prof. Dr.-Ing. Thomas Wimmer, Chairman of the Board of Bundesvereinigung Logistik (BVL) e.V.

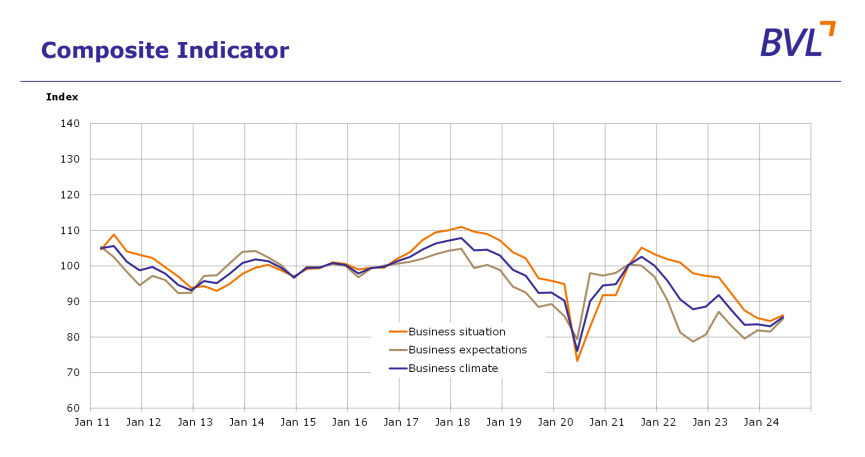

From the beginning of 2023, the Logistics Indicator seemed to know only one direction, sliding further quarter by quarter and accompanied by a continuous downtrend in both assessments of the current business situation and business expectations in the logistics sector. The figures for Q2 2024 are at last painting a more positive picture once again. Although the scores for all the indicators are still well below 90 points and therefore in the negative corridor, there has been significant improvement in assessments of the current business situation, the business climate and expectations for the next six months.

As always, the sub-indicators for trade and industry as well as the logistics service providers are especially interesting. All three individual indicators for business situation, climate and expectations are ticking upwards on both the supply and demand side of the logistics sector. While these indicators are climbing evenly for the service providers, the business expectations in trade and industry are outperforming the other two indicators and are better than the current business situation for the first time in years. These more positive expectations underpin the prediction of a turnaround, provided that – as was the case at the onset of the corona pandemic, when many forecast a far more rapid recovery – nothing serious happens.

But we are now seeing positive reports from a variety of sectors that actually do point to a recovery. There was once again slight growth in the German economy in the first quarter, and there were also some highly optimistic voices at last Thursday’s meeting of BVL’s Advisory Board. The optimists expect the economy to pick up significantly in the second half of the year and are in the process of building up stocking levels in order to meet fresh demand right out of the gate. If the improved expectations of the shippers become reality, then past experience tells us that the business uptrend among the service providers will soon follow.

Construction, manufacturing, trade and some service sectors were able to marginally increase their output, but the ifo Institute found that the unfavourable order scenario in many companies and insufficient demand for the goods they produce served to prevent stronger growth of production output. Private consumption and company investments both fell accordingly during the early part of the year. At the same, however, foreign demand, residential construction and government investment were all on an uptrend. Even though production capacity throughout the economy is still noticeably under-utilised and despite the fact that the downtrend in consumer spending in Q1 came as something of a surprise, the signs now appear to be pointing to recovery in the logistics sector. Didn’t someone say that psychology plays an important role in the economic trend?

Downloads

- Detailed results ( PDF, 95 Kb)

- Commentary by ifo Institute, Prof. Wollmershäuser ( PDF, 97 Kb)

- Commentary by BVL's President Prof. Thomas Wimmer ( PDF, 23 Kb)