Countries have been dealing with stagnant municipal waste recycling rates for some time. Plastics or plastic waste is one of the core challenges that nations across the globe face. But there are sources of inspiration to solve the problem. Switzerland’s emerging waste and plastics collection supply chains present not only an object of study but an innovative and largely overlooked opportunity to move countries towards greater material circularity. Switzerland is a place worth looking for inspiration for new business opportunities.

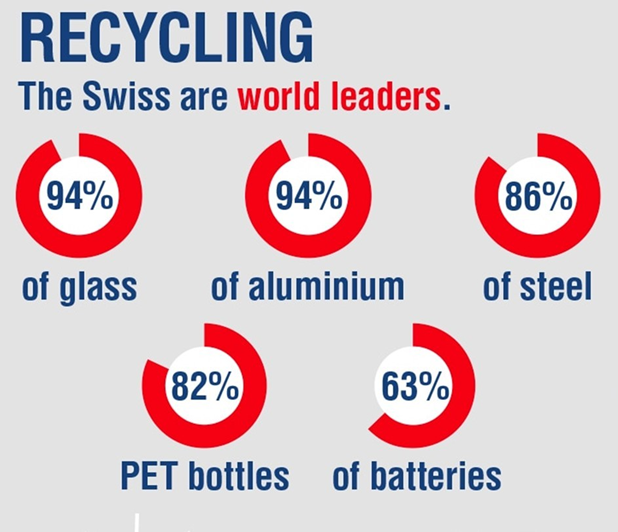

What makes Switzerland different? First, Switzerland achieves high recycling rates (Figure 1) by applying a different regulatory approach to recycling compared to other European countries. The major difference lies in who bears the cost of recycling.

Generally, countries can choose between the producers and consumers to take the ultimate responsibility. While many nations focus on “extended producer responsibility (EPR)” regulation to fund recycling, Switzerland follows the “polluter pays” principle. This means that consumers bear the cost of recycling. Furthermore, citizens are also requested to participate in the recycling process, by manually separating items into over 20 waste streams, which they then deposit in regional / local collection centers. Those citizens that do not follow the waste management rules can face stiff fines. This system works well – with overall recycling rates but also yields amongst the highest in Europe (50%+).

Everyone has areas of improvement: a gap to be filled in Switzerland

Everyone can get better, all the time. In Switzerland, there is almost no collection or recycling of either plastics or beverage packaging. Consumers largely put these into household mixed waste, which goes directly for incineration. Not truly a solution that is following circular economy principles.

In 2022, Switzerland consumed over 1 million tons of plastics and generated over 780,000 tons of plastic waste. That same year, only 80kT of waste was recycled, i.e. just 10%; the rest (c. 700kT) was incinerated. The remaining waste represents an opportunity to save 1.2 million tons of CO2e through mechanical recycling and alternative treatment methods.

In addition, this gap leaves a lot of room for governments and companies to create significant new value for businesses and society. Within this, the logistics sector can play an important role.

The role of logisticians and waste collectors in circular models

The polluter pays principle opens an interesting opportunity to build the transport and waste collection value chain directly to the consumer. In most countries, waste collection is regulated by local governments. In the Swiss model case, consumers are free to choose between taking their recyclable waste to a local collection point or choosing one of several services to collect their waste.

Plastics recyclers have been scaling up dedicated plastic collection systems, such as Sammelsack, a service run by plastic recycling company InnoRecycling. Independent services such as WeRecycle and Mr. Green offer consumers a convenient solution for the collection and sorting of all their mixed recyclable waste- not just plastic.

The size of the prize. With 4 million households and 600,000 enterprises, Switzerland is conservatively a EUR 1.1bn market for providing such collection services for recyclable material. This estimate excludes the potential from monetization of collected waste, the setup of dedicated closed-loop systems for larger products or general municipal solid waste (MSW) retrieval.

Both opportunities, dedicated plastic collection systems and circular models to monetize waste will be part of the offering of next generation logistics and waste management providers.

The beauty of the Swiss model case

Two reasons support the hypothesis of differentiation and attractiveness of the Swiss approach, which can be a model case for other countries.

First, businesses in this space are entirely funded from consumer subscriptions and are financially sustainable and extremely efficient, with no need for government subsidies. This is in stark contrast to countries that depend on indirect transfers from brands and packaging producers under an EPR scheme.

In addition, the lack of compulsory EPR regulation ensures that companies that collect waste own the plastic they collect and can monetize it directly. In many countries plastic waste belongs to a public waste fund or is distributed to EPR providers through an allocation system, taking the business opportunity away from many private sector entrepreneurs that wish to position themselves in the circular economy plastic recycling space.

Conclusions

Participation and collection volumes can even increase with more frequent pickups, as evidenced by the recent FlexCollect pilot in the United Kingdom. Such systems deliver higher recycling rates for key materials. A company we at Anchor Group evaluated recently delivers a 6x higher recycling of plastics versus the municipal collection system and better or equally good recycling rates of other materials.

Waste management in the circular age is an exciting opportunity for companies in waste management and logistics. Focusing on supporting the build-up of a circular economy, whether in Switzerland or beyond offers new business opportunities for logistics and waste management companies. Regulators may have a closer look at the Swiss model case. A shift in recycling responsibility might be easier achieved in countries where regulation around waste management and recycling is less developed. As we can learn a lot from the experiences of others in other places, a broader study on recycling practices and a regular look over the fence might be a good idea to pick up for businesses and policymakers alike.

About the authors

Dweep Chanana is Managing Partner at Anchor Group. He has led over 20 industrial and technology M&A, investment and new ventures with leading corporates and institutional investors. He was previously head of venture investments at Momenta Partners, Director, Strategy and Business Development for Family Services at UBS, worked at the United Nations in Kenya on private sector development. An engineer by training, he has also worked at Lucent and Hughes.

Wolfgang Lehmacher is Partner at Anchor Group. The formerDirector at the World Economic Forum, and CEO Emeritus of GeoPost Intercontinental, is anAdvisory Board member of The Logistics and Supply Chain Management Society, Ambassador F&L, Advisor Global:SF and RISE, and member of Think Tanks Logistikweisen andNEXST. He is Author of The Global Supply Chain and Circular Economy, and co-author of Disrupting Logistics: Startups, Technologies, and Investors Building Future Supply Chains.

Leave a Reply